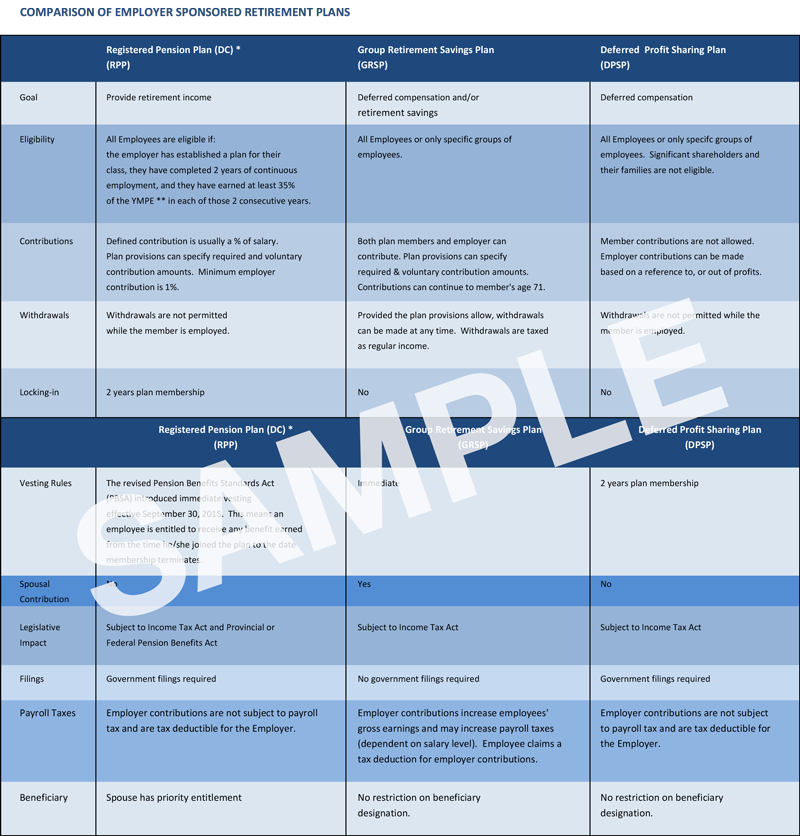

Goal To provide deferred compensation to employees

Eligibility An employer can offer the DPSP to all employees or only a specific group of employees. Significant shareholders and their families are not eligible.

Contributions Member contributions are not allowed. Employer contributions may be based on a reference to, or out of profits.

Withdrawals Withdrawals are not permitted while the member is actively employed.

Locking-In There is no locking-in provision.

Vesting Contributions are vested to the employee after 2 years of plan membership

Spousal Spousal contributions are not permitted.

Payroll taxes Employer contributions are not subject to payroll tax and are tax deductible for the employer.

Filings Government filings are required.

Retirement Accumulated savings do not need to provide lifetime retirement income. A member can transfer the funds to an RRSP, purchase an annuity, receive instalment payments or receive the funds as a lump-sum payment.

Beneficiary There is no restriction on beneficiary designation.

E&oe